----------

Topics

The goal of the survey

Economic models of investor choice over long horizons

The survey

Analysis of results

Conclusions

-----------

Topic 1

The Goal of the Survey

------------

The Survey

Designed to elicit individual choices under uncertainty

. decisions with long horizons

. focus on a single outcome

.. retirement standard of living

. provide trade-offs based on plausible model of capital market opportunities

Current results preliminary

. small number of participants

. sample may not be adequately representative of investors

--------

Key Questions

Compatibility of responses with a standard model of investor choice

. maximization of expected utility

. utility a power function of wealth

.. Constant Relative Risk Aversion (CRRA)

Two issues

. how many participants make CRRA compatible choices?

. in aggregate, are the responses CRRA compatible?

.. does the "representative investor" maximize a CRRA utility function?

----------

Topic 2

Economic Models of Investor Choice over long horizons

----------

Models of Investor Behavior

Equilibrium models

. based on assumptions about the preferences of the "representative investor"

Financial planning advice

. assumptions about the preferences of each individual investor

---------

Expected Utiity Maximization

An investor's utility is a function of consumption and/or wealth

The investor's goal is to maximize the expected value of utility

-------

CRRA Utility Functions

Assume outcome can be stated as a measure of future wealth (w)

Constant Relative Risk Aversion (CRRA) utility function

. u(w) = w1-l / (1-l )

Marginal utility

. mu(w) = w-l

------------

IID Processes

A return process is independent and identically distributed (IID) if

. the distribution of returns is the same each period

. regardless of the returns in prior periods

-------------

Constant-mix Strategies

If

. joint distribution of returns is IID, and

. an investor maximizes the expected value of a CRRA utility function

Then

. the investor should hold the same proportional values of assets every period

. a constant-mix strategy (CMS)

Therefore

. IID + CRRA ===> CMS

Many financial planners advocate constant-mix strategies for their clients

. thus they may implicitly assume CRRA preferences for every investor

-----------

Lognormal Distributions

The value-relative (1+return) after n periods will equal the product of the n one-period value relatives

Therefore the logarithm of the n-period value relative will equal the sum of the logarithms of the n one-period value relatives

If the return process is IID

. the n-period value relative will approach lognormality as n increases

------------

Binomial IID Processes

Discrete counterpart to standard continuous time model

Two investments

. a riskless bond

. a stock (representing the stock market)

Two states of the world in each period

. in one the stock goes up

. in the other the stock goes down

For a horizon of n periods there will be 2n possible sets of one-period outcomes

. each will have an ending stock value relative

. stock value-relative in ending state s = Ws

---------

State Prices

The Arrow-Debreu Price for a state

. the present cost of obtaining $1 if and only if that state occurs

One-period

. two states

. two prices

n-period outcomes

. 2n states

. 2n prices (but not all different)

. price for $1 in ending state s = Ps

---------

Price/wealth relationships with binomial returns

Define log-linear price/wealth (LLPW) as:

. ln(Ps ) = a + b*ln(Ws )

If returns are binomial IID

. ln(Ps ) = a + b*ln(Ws )

---------------

First-order Condition for Expected Utility Maximization

For every state s

. expected marginal utility of wealth = k*price

If every state is equally probable

. mu(ws ) = k*Ps

for CRRA utility

. mu(ws ) = ws-l

Thus

. Ps = K*(ws-l )

. ln(Ps) = ln(K) - l*ln(ws)

------------

Sufficient Conditions for LLPW Relationship

Stock returns follow a binomial IID process, or

Representative investor has a CRRA utility function

--------------

Properties of Constant-mix Strategies

Constant-mix Strategy

. bond/stock mix constant in percentage terms

. in a continuous process, constant every instant

. in a binomial process, constant every period

Ending value relatives

. lognormally distributed

If stocks are LLPW, for any constant mix strategy

. ln(w) linearly related to ln(P)

. ln(w) linearly related to ln(w) for any other constant mix strategy

----------------

Topic 3

The Survey

----------

Participants

Employees and friends from a financial services firm

. most between 20 and 40 years old

. well educated

. many with degrees in finance or engineering

. many familiar with investing for retirement

Participation solicited for three weeks

Number of participants

. 71 total

.. 66 first-time, 5 repeat

. 66 utilized

Median time to complete survey = 10.7 minutes

----------

Measure of Wealth

Standard of living in retirement

Expressed as a percentage of pre-retirement standard of living

---------

Markers

100

Each represented by a question mark

One is the participant

The participant doesn't know which one represents him or her

Initially, all markers are in a reserve row

The ojective is to place the markers in a pattern in the rows in a playing field

----------

------------

The Budget Constraint

The cost of a pattern

. computed based on set of state prices

. survey cannot be completed unless the cost is between 99%% and 100%% of a fixed budget

The Riskless Alternative

. all markers in the 75%% row

----------

-----------

States of the World

All returns in real terms

100 States

. obtained from discrete approximations of lognormal distributions

.. each state equally probable

.. taken from cumulative distribution at 0.005, 0.015,.. 0.995

Properties of stock value relatives

. 10 year horizon

. all returns in real terms

. riskless rate of interest

.. 2%% per year

. stock returns independent and identically distributed (IID)

. lognormal distribution of stock market value relatives

. one-year stock risk and return

.. expected return = 8%%

.. standard deviation = 18%%

------------

Computing the Set of State Prices

Assume LLPW

Properties of state prices

. ln(P) = a - b*ln(W)

. Ss Ps = 1 / 1.0210

. Ss Ps *Ws = 1

Solve non-linear equation to find a and b

. determines the price for each state

State prices can be used to value any set of payoffs in states

-------------

Determining the Cost of a Distribution

The cost of wealth in state s

. cs = Ps*ws

The total cost of the distribution

. C = Ss cs

Initial budget

. 75 / 1.0210 = 61.52

-------------

Implementing a probability distribution

For each marker

. determine wealth level

. assign to a state

Cost of the assignment

. C = Ss cs

Express as a percent of initial budget

-----------------

Determining a Least-cost Assignment

A distribution will not be least cost if

. payoff in state s < payoff in state s+1 and

. price for state s < price for state s+1

To find the least-cost of a Distribution

. order states from lowest to highest state price

. assign payoffs to states from highest to lowest

Every distribution is assigned to states automatically using this method

. guarantees least-cost

------------

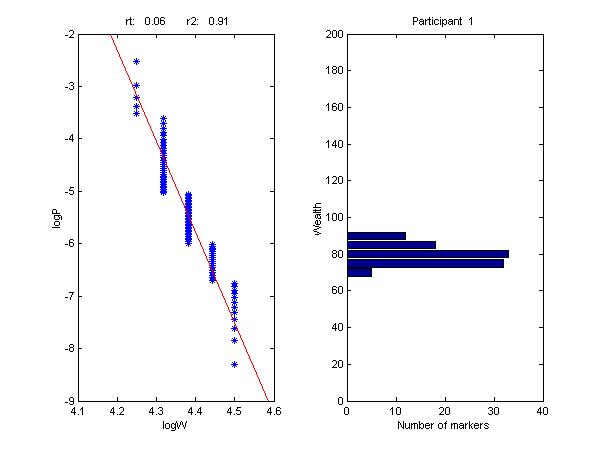

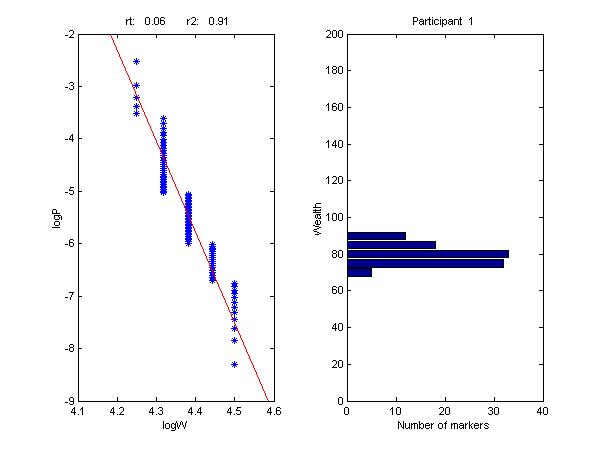

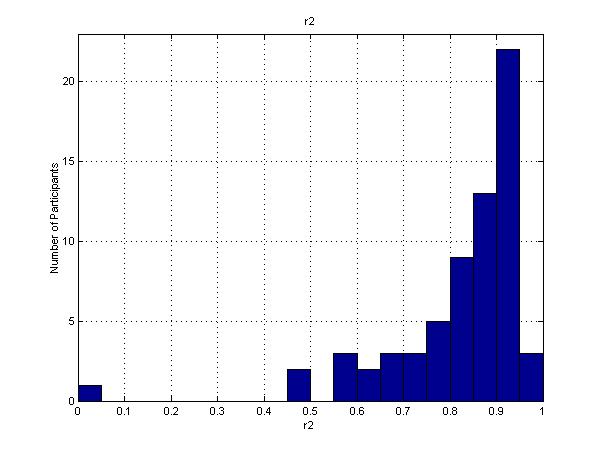

Measuring Conformance with a CRRA Utility Function

Given distribution, assign wealths to states

. based on least-cost

Regress ln(w) on ln(P)

. since P values are given, and participant chooses w values

. result is the best-fit CRRA utility function

Slope coefficient measures risk tolerance (rt)

R-squared (r2) measures degree of conformance to CRRA utility function

. statistical, not necessarily economic

---------

Responses by Participant #1

--------------------

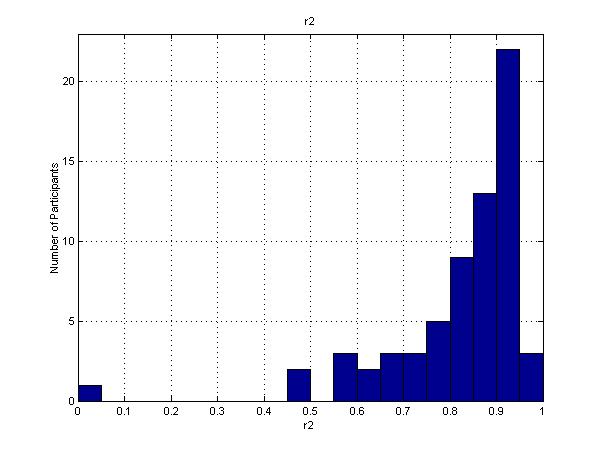

R2 Values for All Participants

--------------------

R2 Values for All Participants

--------------------

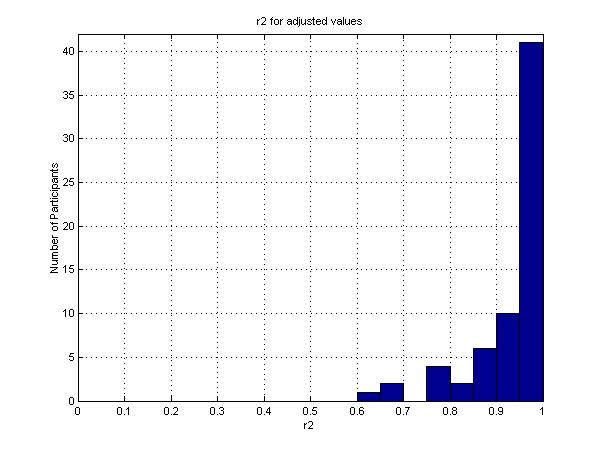

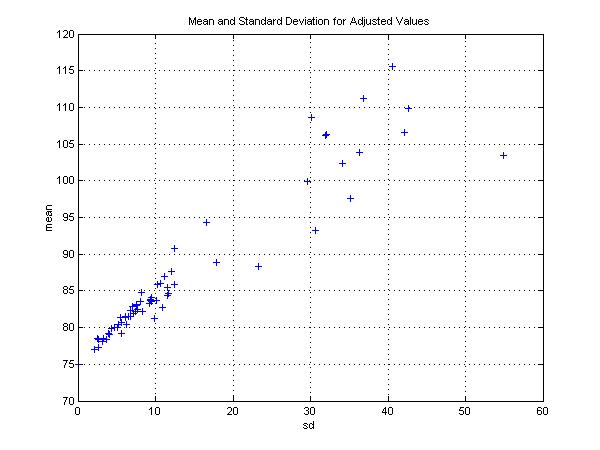

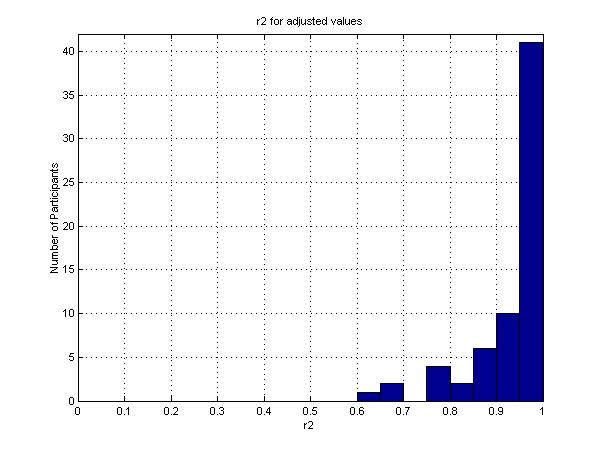

Adjusted Values

Grid for responses is coarse

. 5%%, 10%%, ..., 200%%

Measured r2 value is a lower bound on the r2 value that might be obtained with a finer grid

To find an upper bound

. adjust the wealth in each state towards the regression line

. maximum adjustment = 2.5%%

Fit a new regression line and measure r2

. provides an upper bound

-----------

R2 values for Adjusted Values

--------------------

Adjusted Values

Grid for responses is coarse

. 5%%, 10%%, ..., 200%%

Measured r2 value is a lower bound on the r2 value that might be obtained with a finer grid

To find an upper bound

. adjust the wealth in each state towards the regression line

. maximum adjustment = 2.5%%

Fit a new regression line and measure r2

. provides an upper bound

-----------

R2 values for Adjusted Values

--------------------

Conformance with CRRA Utility Function

A majority of participants conform reasonably well with CRRA

. for them a constant mix strategy may be appropriate

A significant minority of participants exhibit preferences that do not conform well with CRRA

. for them a dynamic strategy may be preferable

--------------

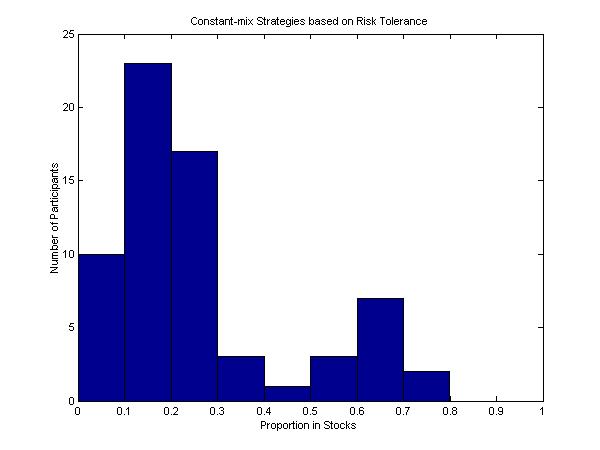

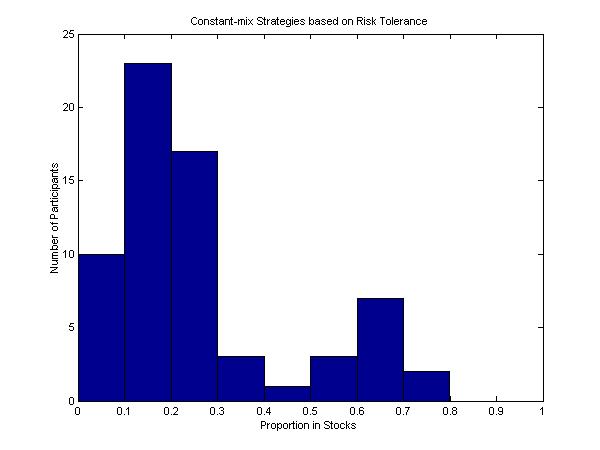

Finding Comparable Constant Mix Strategies

Estimate risk tolerance from a regression of log(w) on

--------------------

Conformance with CRRA Utility Function

A majority of participants conform reasonably well with CRRA

. for them a constant mix strategy may be appropriate

A significant minority of participants exhibit preferences that do not conform well with CRRA

. for them a dynamic strategy may be preferable

--------------

Finding Comparable Constant Mix Strategies

Estimate risk tolerance from a regression of log(w) on

log(p)

Find combination of bonds and stocks with the same risk tolerance

Result is a comparable constant mix strategy

---------

Constant-mix Strategies for All Participants

--------------------

Participant Risk Tolerances

All participants are more conservative than an all-stock investor

May be representative of smaller investors

. market portfolio of traded securities approximately 60%% stocks

. retirement standard of living includes lower-risk assets

.. real estate

.. social security

.. money market funds

.. other real assets

------------

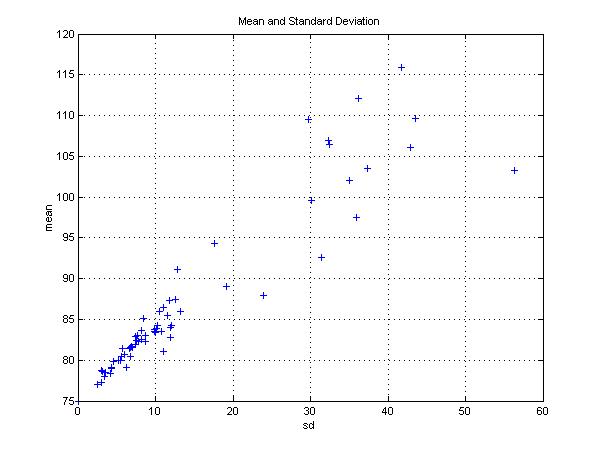

Mean/Variance Efficiency

A strategy is mean/variance efficient if no other strategy has

. the same variance and higher mean,

. the same mean and lower variance, or

. higher mean and lower variance

Unless utility is well approximated by a quadratic function of wealth

. some utility-maximizing distributions will not be mean/variance efficient

------------

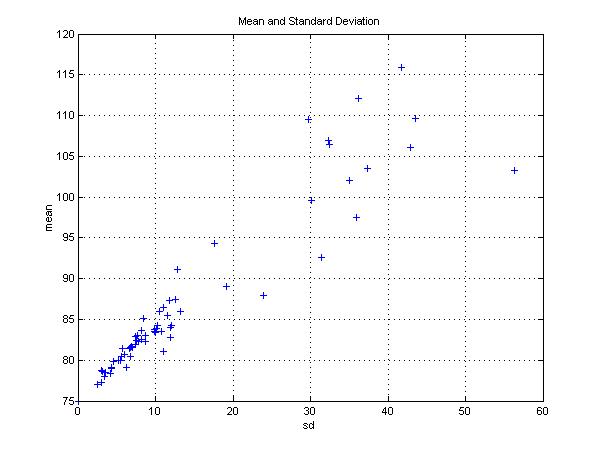

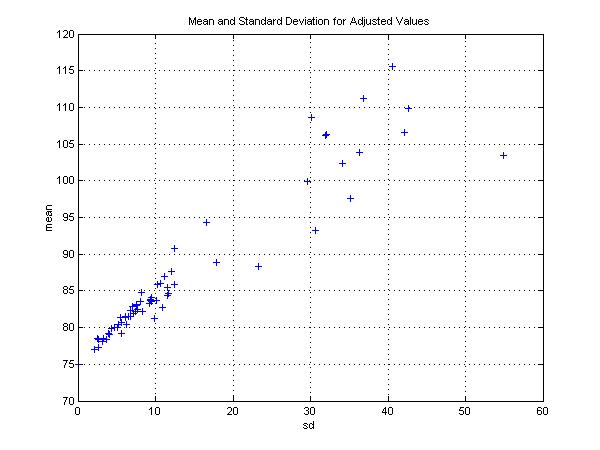

Mean and Standard Deviation

--------------------

Participant Risk Tolerances

All participants are more conservative than an all-stock investor

May be representative of smaller investors

. market portfolio of traded securities approximately 60%% stocks

. retirement standard of living includes lower-risk assets

.. real estate

.. social security

.. money market funds

.. other real assets

------------

Mean/Variance Efficiency

A strategy is mean/variance efficient if no other strategy has

. the same variance and higher mean,

. the same mean and lower variance, or

. higher mean and lower variance

Unless utility is well approximated by a quadratic function of wealth

. some utility-maximizing distributions will not be mean/variance efficient

------------

Mean and Standard Deviation

--------------------

Mean and Standard Deviation for Adjusted Values

--------------------

Mean and Standard Deviation for Adjusted Values

--------------------

Mean/Variance Efficiency of Participant Choices

Participant choices are not all mean/variance efficient in terms of final wealth

. especially true for higher-risk choices

But choices are mean/variance efficient in the short run

. for a binomial process, each period

. for a continuous process, each instant

---------

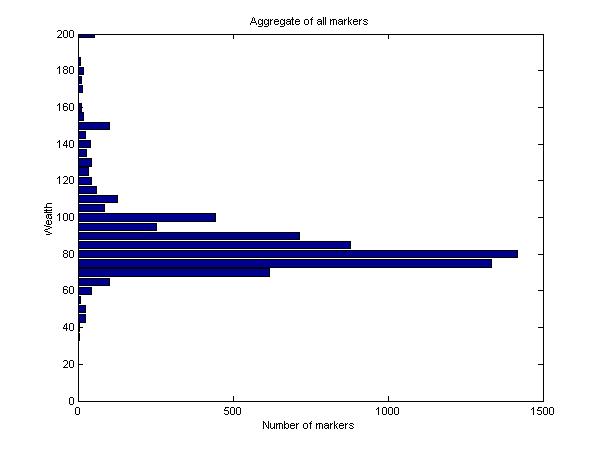

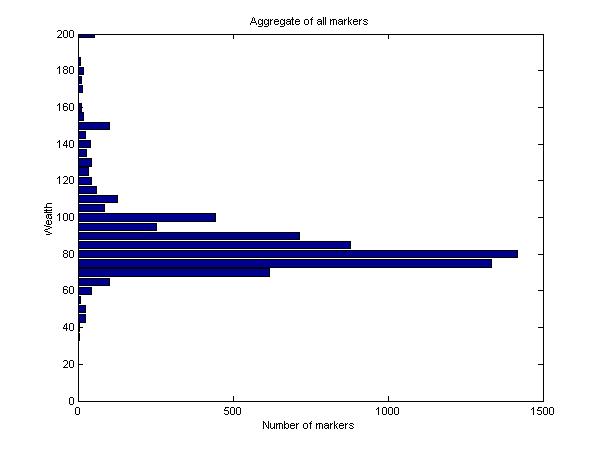

Preferences of the Representative Investor

Summary data

. aggregate of all markers

Consistency with models of capital markets

. total wealth desired in each state

--------

Aggregate of All Markers

--------------------

Mean/Variance Efficiency of Participant Choices

Participant choices are not all mean/variance efficient in terms of final wealth

. especially true for higher-risk choices

But choices are mean/variance efficient in the short run

. for a binomial process, each period

. for a continuous process, each instant

---------

Preferences of the Representative Investor

Summary data

. aggregate of all markers

Consistency with models of capital markets

. total wealth desired in each state

--------

Aggregate of All Markers

--------------------

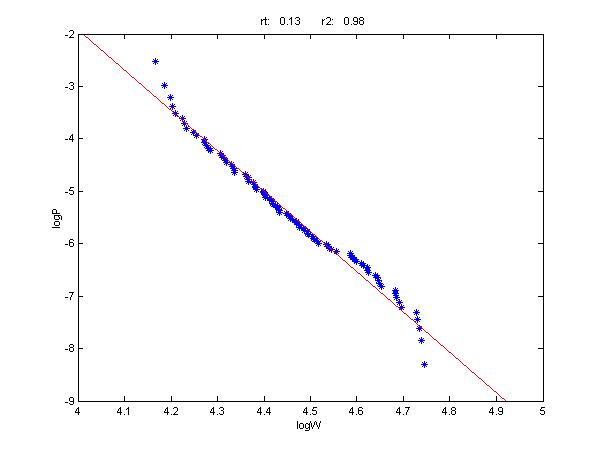

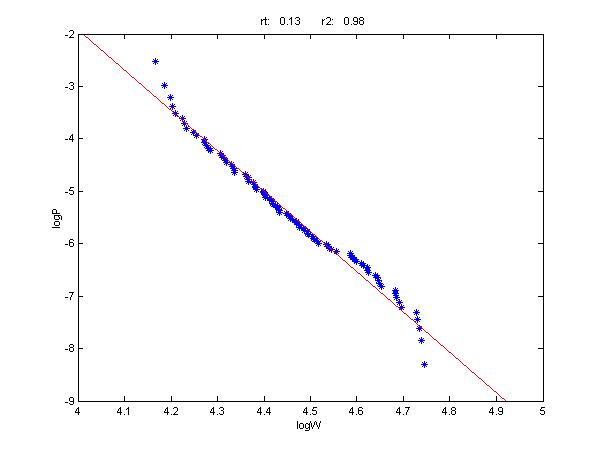

Desired ln(w) and ln(P)

--------------------

Desired ln(w) and ln(P)

--------------------

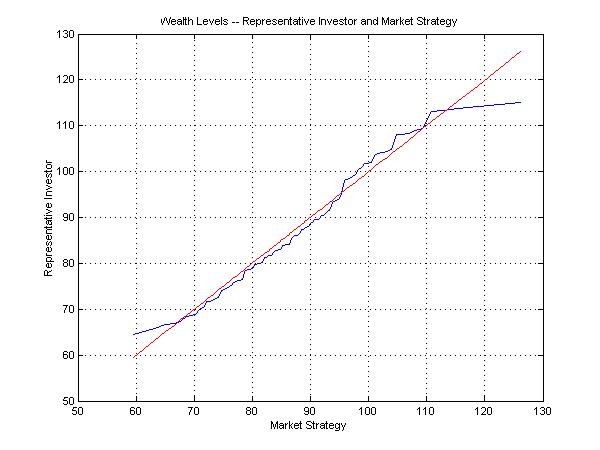

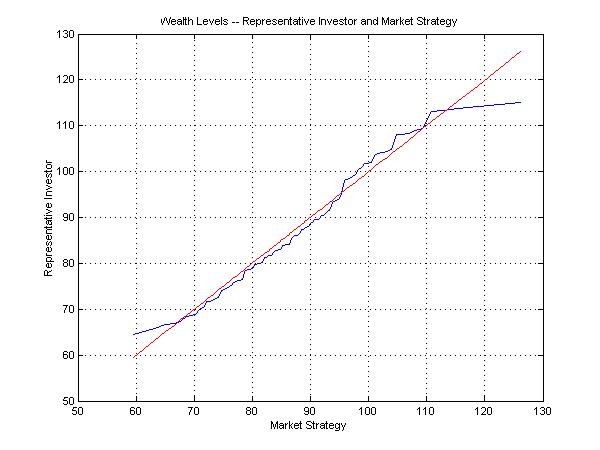

Characteristics of the Representative Investor

Relatively conservative

. comparable constant-mix strategy = 26.5%% stocks

Conforms quite well with CRRA utility

. r2 = 0.98

Can be compared with market strategy with 26.5%% stocks

------------

Wealth Levels -- Representative Investor and Market Strategy

--------------------

Characteristics of the Representative Investor

Relatively conservative

. comparable constant-mix strategy = 26.5%% stocks

Conforms quite well with CRRA utility

. r2 = 0.98

Can be compared with market strategy with 26.5%% stocks

------------

Wealth Levels -- Representative Investor and Market Strategy

--------------------

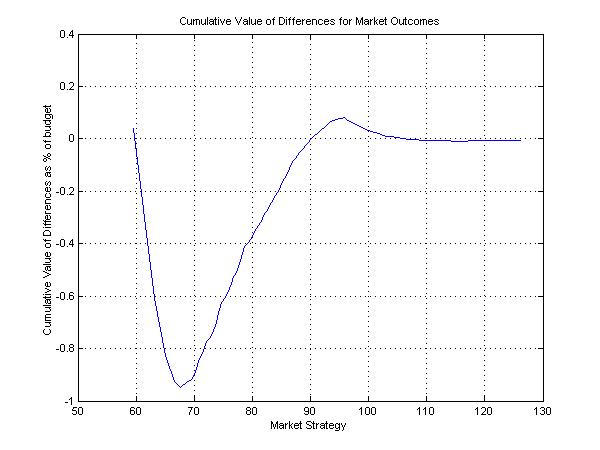

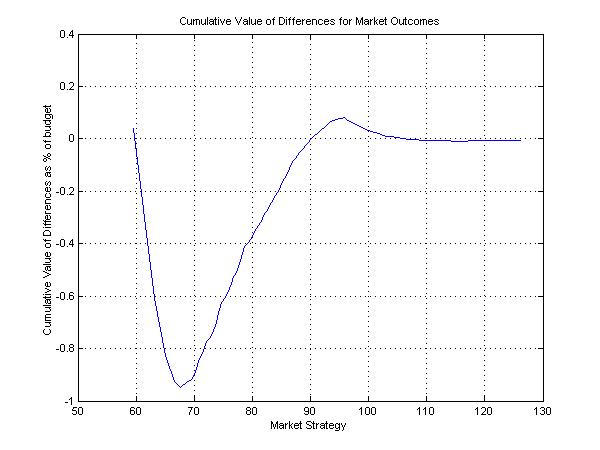

Deviations from Market Strategy

Probably not significant in terms of preferences

. small sample size

. possible biases

.. reference points from prior experience (70%% as a target standard of living)

Characteristics

. downside protection in severe bear markets

. lower return in moderate bear and bull markets

. higher return in substantial bull markets

. lower return in extreme bull markets

Economic values of differences small

. expressed as percent of initial budget

-------------

Cumulative Value of Differences by Market Outcome

--------------------

Deviations from Market Strategy

Probably not significant in terms of preferences

. small sample size

. possible biases

.. reference points from prior experience (70%% as a target standard of living)

Characteristics

. downside protection in severe bear markets

. lower return in moderate bear and bull markets

. higher return in substantial bull markets

. lower return in extreme bull markets

Economic values of differences small

. expressed as percent of initial budget

-------------

Cumulative Value of Differences by Market Outcome

--------------------

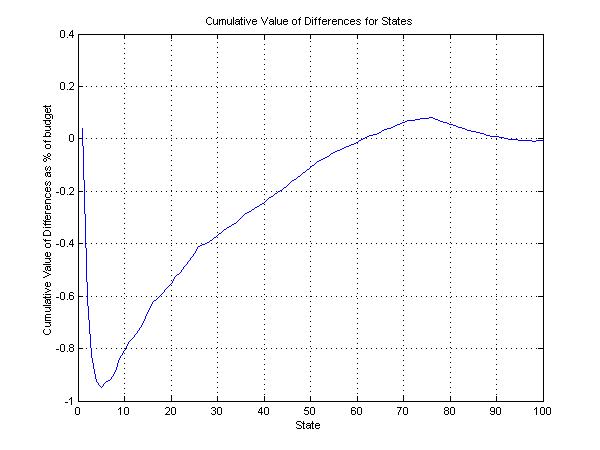

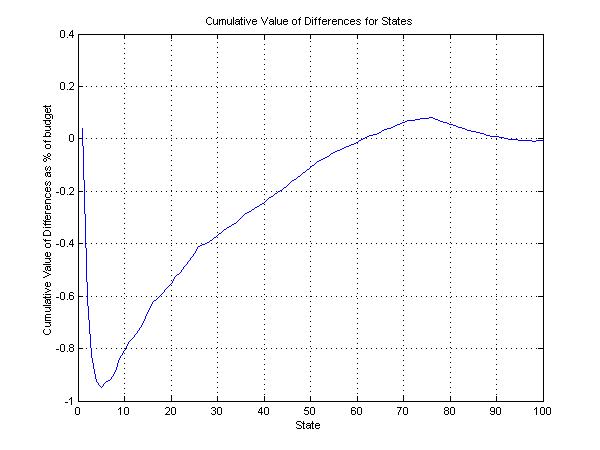

Cumulative Value of Differences by State

--------------------

Cumulative Value of Differences by State

--------------------

Topic 5

Conclusions

-------------

Conclusions: Aggregate Preferences

Aggregate preferences conform well with standard assumptions

. the representative participant has preferences close to those of an investor with CRRA utility

. the economic value of the differences is less than 1%% of total value

. there is less than a 5%% probability of downside protection

-------------

Conclusions: Individual Preferences

A majority of participants conform reasonably well to standard assumptions

. 25 of 66 had r2 values above 0.90

. 51 of 66 had upper bound r2 values above 0.90

. for them constant mix strategies may be appropriate

A substantial minority of partipants did not conform well with standard assumptions

. for them dynamic strategies may be preferable

. but only if added expected utility exceeds cost

-----------

Conclusions: Overall

All results are highly preliminary

Expanded surveys planned

. larger and more diverse sample size

. after choice made, show comparable constant mix strategy

.. ask participant to indicate %% of budget that would be spent to obtain this distribution

.. would provide an economic measure of the certainty equivalent of the loss in expected utility

. vary riskless alternative among participants

.. would provide evidence of sensitivity of preferences to wealth

More research is needed

==============

--------------------

Topic 5

Conclusions

-------------

Conclusions: Aggregate Preferences

Aggregate preferences conform well with standard assumptions

. the representative participant has preferences close to those of an investor with CRRA utility

. the economic value of the differences is less than 1%% of total value

. there is less than a 5%% probability of downside protection

-------------

Conclusions: Individual Preferences

A majority of participants conform reasonably well to standard assumptions

. 25 of 66 had r2 values above 0.90

. 51 of 66 had upper bound r2 values above 0.90

. for them constant mix strategies may be appropriate

A substantial minority of partipants did not conform well with standard assumptions

. for them dynamic strategies may be preferable

. but only if added expected utility exceeds cost

-----------

Conclusions: Overall

All results are highly preliminary

Expanded surveys planned

. larger and more diverse sample size

. after choice made, show comparable constant mix strategy

.. ask participant to indicate %% of budget that would be spent to obtain this distribution

.. would provide an economic measure of the certainty equivalent of the loss in expected utility

. vary riskless alternative among participants

.. would provide evidence of sensitivity of preferences to wealth

More research is needed

============== --------------------

R2 Values for All Participants

--------------------

R2 Values for All Participants

--------------------

Adjusted Values

Grid for responses is coarse

. 5%%, 10%%, ..., 200%%

Measured r2 value is a lower bound on the r2 value that might be obtained with a finer grid

To find an upper bound

. adjust the wealth in each state towards the regression line

. maximum adjustment = 2.5%%

Fit a new regression line and measure r2

. provides an upper bound

-----------

R2 values for Adjusted Values

--------------------

Adjusted Values

Grid for responses is coarse

. 5%%, 10%%, ..., 200%%

Measured r2 value is a lower bound on the r2 value that might be obtained with a finer grid

To find an upper bound

. adjust the wealth in each state towards the regression line

. maximum adjustment = 2.5%%

Fit a new regression line and measure r2

. provides an upper bound

-----------

R2 values for Adjusted Values

--------------------

Conformance with CRRA Utility Function

A majority of participants conform reasonably well with CRRA

. for them a constant mix strategy may be appropriate

A significant minority of participants exhibit preferences that do not conform well with CRRA

. for them a dynamic strategy may be preferable

--------------

Finding Comparable Constant Mix Strategies

Estimate risk tolerance from a regression of log(w) on

--------------------

Conformance with CRRA Utility Function

A majority of participants conform reasonably well with CRRA

. for them a constant mix strategy may be appropriate

A significant minority of participants exhibit preferences that do not conform well with CRRA

. for them a dynamic strategy may be preferable

--------------

Finding Comparable Constant Mix Strategies

Estimate risk tolerance from a regression of log(w) on  --------------------

Participant Risk Tolerances

All participants are more conservative than an all-stock investor

May be representative of smaller investors

. market portfolio of traded securities approximately 60%% stocks

. retirement standard of living includes lower-risk assets

.. real estate

.. social security

.. money market funds

.. other real assets

------------

Mean/Variance Efficiency

A strategy is mean/variance efficient if no other strategy has

. the same variance and higher mean,

. the same mean and lower variance, or

. higher mean and lower variance

Unless utility is well approximated by a quadratic function of wealth

. some utility-maximizing distributions will not be mean/variance efficient

------------

Mean and Standard Deviation

--------------------

Participant Risk Tolerances

All participants are more conservative than an all-stock investor

May be representative of smaller investors

. market portfolio of traded securities approximately 60%% stocks

. retirement standard of living includes lower-risk assets

.. real estate

.. social security

.. money market funds

.. other real assets

------------

Mean/Variance Efficiency

A strategy is mean/variance efficient if no other strategy has

. the same variance and higher mean,

. the same mean and lower variance, or

. higher mean and lower variance

Unless utility is well approximated by a quadratic function of wealth

. some utility-maximizing distributions will not be mean/variance efficient

------------

Mean and Standard Deviation

--------------------

Mean and Standard Deviation for Adjusted Values

--------------------

Mean and Standard Deviation for Adjusted Values

--------------------

Mean/Variance Efficiency of Participant Choices

Participant choices are not all mean/variance efficient in terms of final wealth

. especially true for higher-risk choices

But choices are mean/variance efficient in the short run

. for a binomial process, each period

. for a continuous process, each instant

---------

Preferences of the Representative Investor

Summary data

. aggregate of all markers

Consistency with models of capital markets

. total wealth desired in each state

--------

Aggregate of All Markers

--------------------

Mean/Variance Efficiency of Participant Choices

Participant choices are not all mean/variance efficient in terms of final wealth

. especially true for higher-risk choices

But choices are mean/variance efficient in the short run

. for a binomial process, each period

. for a continuous process, each instant

---------

Preferences of the Representative Investor

Summary data

. aggregate of all markers

Consistency with models of capital markets

. total wealth desired in each state

--------

Aggregate of All Markers

--------------------

Desired ln(w) and ln(P)

--------------------

Desired ln(w) and ln(P)

--------------------

Characteristics of the Representative Investor

Relatively conservative

. comparable constant-mix strategy = 26.5%% stocks

Conforms quite well with CRRA utility

. r2 = 0.98

Can be compared with market strategy with 26.5%% stocks

------------

Wealth Levels -- Representative Investor and Market Strategy

--------------------

Characteristics of the Representative Investor

Relatively conservative

. comparable constant-mix strategy = 26.5%% stocks

Conforms quite well with CRRA utility

. r2 = 0.98

Can be compared with market strategy with 26.5%% stocks

------------

Wealth Levels -- Representative Investor and Market Strategy

--------------------

Deviations from Market Strategy

Probably not significant in terms of preferences

. small sample size

. possible biases

.. reference points from prior experience (70%% as a target standard of living)

Characteristics

. downside protection in severe bear markets

. lower return in moderate bear and bull markets

. higher return in substantial bull markets

. lower return in extreme bull markets

Economic values of differences small

. expressed as percent of initial budget

-------------

Cumulative Value of Differences by Market Outcome

--------------------

Deviations from Market Strategy

Probably not significant in terms of preferences

. small sample size

. possible biases

.. reference points from prior experience (70%% as a target standard of living)

Characteristics

. downside protection in severe bear markets

. lower return in moderate bear and bull markets

. higher return in substantial bull markets

. lower return in extreme bull markets

Economic values of differences small

. expressed as percent of initial budget

-------------

Cumulative Value of Differences by Market Outcome

--------------------

Cumulative Value of Differences by State

--------------------

Cumulative Value of Differences by State

--------------------

Topic 5

Conclusions

-------------

Conclusions: Aggregate Preferences

Aggregate preferences conform well with standard assumptions

. the representative participant has preferences close to those of an investor with CRRA utility

. the economic value of the differences is less than 1%% of total value

. there is less than a 5%% probability of downside protection

-------------

Conclusions: Individual Preferences

A majority of participants conform reasonably well to standard assumptions

. 25 of 66 had r2 values above 0.90

. 51 of 66 had upper bound r2 values above 0.90

. for them constant mix strategies may be appropriate

A substantial minority of partipants did not conform well with standard assumptions

. for them dynamic strategies may be preferable

. but only if added expected utility exceeds cost

-----------

Conclusions: Overall

All results are highly preliminary

Expanded surveys planned

. larger and more diverse sample size

. after choice made, show comparable constant mix strategy

.. ask participant to indicate %% of budget that would be spent to obtain this distribution

.. would provide an economic measure of the certainty equivalent of the loss in expected utility

. vary riskless alternative among participants

.. would provide evidence of sensitivity of preferences to wealth

More research is needed

==============

--------------------

Topic 5

Conclusions

-------------

Conclusions: Aggregate Preferences

Aggregate preferences conform well with standard assumptions

. the representative participant has preferences close to those of an investor with CRRA utility

. the economic value of the differences is less than 1%% of total value

. there is less than a 5%% probability of downside protection

-------------

Conclusions: Individual Preferences

A majority of participants conform reasonably well to standard assumptions

. 25 of 66 had r2 values above 0.90

. 51 of 66 had upper bound r2 values above 0.90

. for them constant mix strategies may be appropriate

A substantial minority of partipants did not conform well with standard assumptions

. for them dynamic strategies may be preferable

. but only if added expected utility exceeds cost

-----------

Conclusions: Overall

All results are highly preliminary

Expanded surveys planned

. larger and more diverse sample size

. after choice made, show comparable constant mix strategy

.. ask participant to indicate %% of budget that would be spent to obtain this distribution

.. would provide an economic measure of the certainty equivalent of the loss in expected utility

. vary riskless alternative among participants

.. would provide evidence of sensitivity of preferences to wealth

More research is needed

==============